2024 BUDGET UPDATE

Market Impact

Following the impact of the Budget last week on the UK market and the news of a Trump victory in the US this week, we know that many of you are interested in the impact on your portfolios. Our Chief Investment Officer, James Calder, has prepared a video focusing on the macro economic issues and what these significant events have meant for your CAM investments.

The below copy is a transcript of the video recorded by James, which you can view here.

As expected, our webinars tend to be lumpy in their timing. I’m not a fan of talking for the sake of it but rather believe there is more impact in saying something when we have something to comment upon. This is another of those moments. In the space of little more than a week we have witnessed the new UK government’s first budget, a further interest rate cut in the UK and of course the US presidential election.

Two of the events were UK centric so I will comment on these together. I do not remember any budget being met with such trepidation and worry. In fact, so much so that we made an asset allocation move in the run up to the budget – again I do not remember ever making an allocation move based on what the Chancellor might do. It seemed likely that to us that there would be changes to the tax regime that would lead to a greater tax take. Whilst it was difficult to forecast exactly where these tax rises would be, we did get a guide from the Labour party’s manifesto, no rises in income tax, national insurance and VAT (with some notable exceptions). To us that left capital gains tax as an obvious target. Without getting into the technical detail one part of the UK stock market has benefited from a tax advantage, namely the Alternative Investment Market or commonly known as AIM. This represents the smallest of UK listed companies many of which are nascent and considered higher risk but higher return – the tax advantage encourages investors to take positions. We worried that this advantage might be removed, by how much was difficult to forecast. In our view the worst case situation could be devastating. We call this type of event of a ‘fat tail risk’ – small(ish) chance of happening but if it does it will have an outsized outcome. Due to this within our traditional service we took the view, where possible, to sell our UK small cap funds – they both hold AIM stocks, and they could not be split out. The market deteriorated post our sale as others no doubt worried over the same issue.

One comment that was frequently heard post budget was “it could have been worse” and this was certainly the case for AIM. Whilst there is now a tax levy here it could certainly have been worse. We took the decision to reinvest within UK small caps as the tax risked had passed and the market still remains cheap and attractive.

There are two parts to the budget – the first which affects tax, which my colleagues in wealth planning are covering in the form of commentary. The second part which does fall in my lap is the impact the budget has on the economy. As I have stated before, it is not my place to get political, but rather comment upon the impact of policy. The dust is still settling but a few points can be taken. The tax burden on employers has risen substantially and this will need to be paid for. Growth from this budget, even according to the OBR, will be muted. The Chancellor has changed her fiscal rules to allow for more borrowing but there is not much fiscal head room if her forecasts go the wrong way. I do not believe that hope is a strategy that one can get behind but there appears to be more than a modicum of hope here. With a fair wind in the economy and no shocks it is possible but there is little wiggle room. At this point I get too close to commenting on politics for comfort, but the market concern is that if the goals set are not met then will there be another round of tax rises - this time at the personal level. We need to be clear that it could have been worse relating to personal taxation. Just so there is no ambiguity, this is the biggest tax rise in one budget since the early 1990s, it will have real economy implications.

Yesterday as expected, the Monetary Policy Committee at the Bank of England cut UK base rates by 25bps to 4.75%. Prior to the budget, a December cut was possible that is now doubtful. The MPC has been exceptionally cautious over the last couple of years and I see no reason for that to change. The budget is inflationary and along with an increase in the minimum wage and the employment rights bill, this will drive wage inflation up, but we are not returning to the high levels witnessed only a year or so ago.

The decline in interest rates will continue but at a reduced pace and the terminal level, as in what it falls to, will be higher assuming we do not re-enter recession. We do not see recession as our base case, but the risk of it has increased. Therefore, what does consensus expect? A quarter point cut each quarter for 2025 bringing the rate to 3.75% by year’s end. Do I agree? Well yes for the most part, however with the qualification that the market tends to underestimate rate cutting cycles, so the risk of error is that more rate cuts are experienced.

Circling back to our UK small cap exposure, we felt comfortable enough to re-enter the positions. But why - the short answer is valuations. The UK market is cheap on a historic basis and relative to other markets today. It will benefit from a reduction in rates and inflation, despite the move being slower than we initially envisaged.

Now turning to the US Presidential election and again with the caveat that I am limited to views on the impact of our investment thesis. President Trump’s re-election is short term positive for US market, but we must be mindful of knee-jerk reactions. Asian markets have reacted poorly. So, what does this mean for us, as in will we change anything? The short term answer is no. President Trump is not sworn in until the end of January next year. His rhetoric in the run up to the election is positive in the short term for the US consumer – continuation of tax cuts, removal of red tape for corporates amongst others. What is concerning is whether his comments on trade tariffs should be taken at face value. If so, these are very disconcerting and will lead to inflationary pressures across the globe. At this point we just do not know – he did after all write a book entitled ‘The Art of the Deal’. Is this a negotiating tactic to get more favourable terms from trading partners? We remain comfortable with our current positioning but will of course know more as Trump outlines his plans and announces his cabinet.

I am more cautious on US treasuries – the next President’s spending plans and tax cuts are very large and the deficit is likely to widen (I realise the UK Government is not a bastion of prudence – but it’s still a worry).

At the same time – I am wondering how much of this is a relief rally? With the dollar rallying on the news of a Trump win, a peaceful transition of power is a relief to markets – given it removes the risk of the worst possible outcome (which some market participants have been planning for).

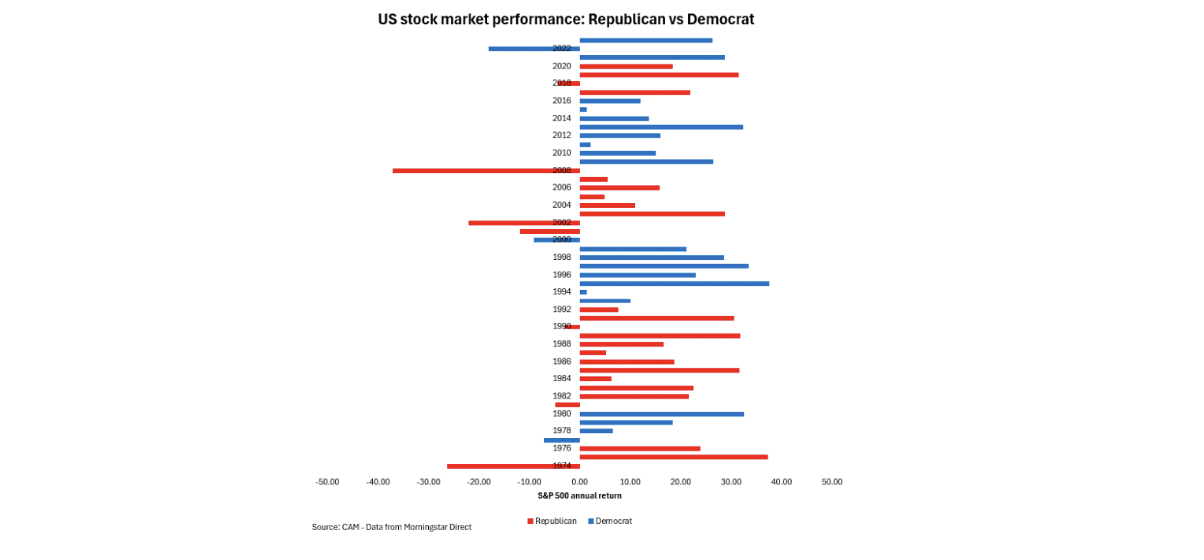

One of my colleagues Max, has done some work on assessing if there is a correlation between different political presidents and market returns. From the chart below, it is clear to see that there is little correlation between the performance of the US stock market and the political party in power.

As long term investors it is important that we don’t allow political views to interfere with the asset allocation process.

I thought a quick update on alternative income would be welcome. The latent value story is coming through for those trusts that have announced corporate activity. As it stands a good handful of our holdings are either in the process of winding up through the sale of portfolio assets and the return of capital or have announced their intention do so. There will be a surviving group of which we remain comfortable with their approach, their viability and performance this year. We are at the whim of news flow, some of which is self-generated, whereas the macro story of falling inflation and interest rates continues to play out albeit more slowly than expected. The thesis remains.

Summing up the last week or so has confirmed our rate thesis (the US should also continue its cutting path). In the UK we have, or I hope we have, a stable government – bond market jury is still out for now, but we did not experience a repeat of the Truss mini-budget – Ms Reeves has some time, but the bond market can be unforgiving.

Overall, I remain comfortable that our generally optimistic disposition remains, albeit with my usual caveats of exogenous shocks. My next update should be a recap of the year and some thoughts on the outlook. Thank you for taking the time to watch and as always if you have any questions, please get in touch with myself or your usual contact.