All (income) is not lost

8 JUNE 2020

The market reaction to the Covid 19 pandemic has many implications. Investment returns on capital dominate the headlines, but income is not only an important part of total return (capital plus income), for many, it provides most of the cash flow required to pay for their daily expenses.

Headlines, such as “Shell cuts it’s dividend for the first time in eighty years” and variations on that theme were commonplace, reflecting a poor outlook as the oil price collapsed.

For most, income is derived from investments with equity dividends (company shares) and fixed interest (bonds issued by corporates). The former has come under pressure due to the weakening of the global economy. Financial stocks, particularly banks, have been forced to cut or withhold their dividend completely by governments/central banks (our own central bank even proposed the press release). As state support becomes more prevalent it is likely that government intervention becomes more frequent as the price for that support. The merits, or otherwise, of this course of action are not for us to comment upon but the ramifications are. Additionally, the UK government has stated publicly that companies making use of it’s loan scheme are banned from paying dividends, unless previously agreed. Again, we are more interested in the effects than the rights or wrongs.

Equity yields have collapsed across the board; this is not just a UK phenomenon, although the UK equity market was one of the highest yielders (substantial oil and banking stock weights). The Investment Association, the trade body for UK mutual funds, has suspended the equity income yield requirements for the UK equity income sector for twelve months from April, in a response to companies slashing dividends due to Covid19. This action reflects the dire situation in which many companies find themselves. The obvious consequence is that those relying on equity dividends are going to have to make do with less. But for how long will this last. We should also be mindful that pension schemes rely on dividend payments for a substantial part of their members’ income and will be vocal supporters of such payments. Some will return, but it is a case of when and the impact of the shortfall in the meantime.

Whereas dividend payments may be seen as a ‘favour’ by companies to reward shareholders for holding their stock, the same cannot be said for fixed interest, or bonds. These are contractual payments and must be paid; if not, the company defaults and the creditors move in to reclaim as much as they can.

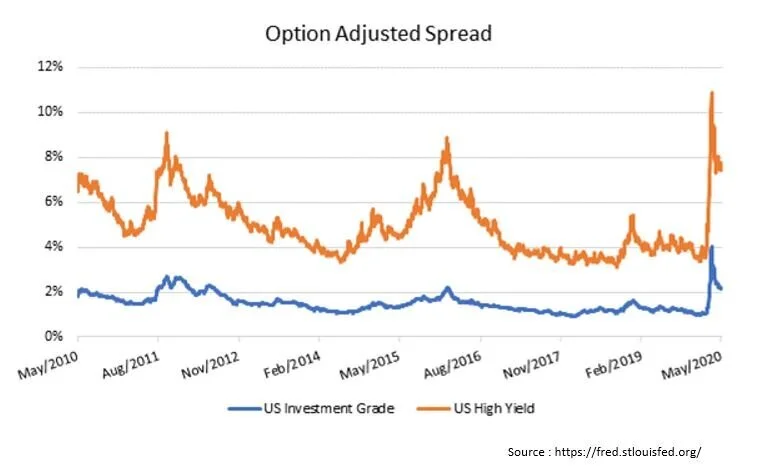

Developed bond markets fall into two parts: investment grade and sub-investment grade. The latter pays a higher coupon but comes with more risk. Both markets are split into different levels of credit ratings meaning you can have higher and lower quality within each. Recent economic conditions have led to the downgrade of credit ratings by third party providers (S&P, Moody’s etc.) from investment grade to sub-investment grade. These ‘fallen angels’ along with a widening of spreads (the compensation over and above government bonds of comparable tenure) has led the sub-investment grade to offer a very attractive yield at headline level. We believe that whilst some of the yields on offer do reflect the extra risk involved with investing there, many do not, leading to a once in a decade buying opportunity. This opportunity has two parts: the capital appreciation as pricing moves up from depressed levels to the redemption value and secondly, the enhanced level of yield.

Therefore, an attractive total return opportunity is available, and for those that wish to use the income element, there is greater visibility in receiving it. Weights to fixed income and particularly sub-investment grade have been increased across all our mandates.

Equity income and fixed income have always played their parts in our multi-asset approach and have provided a substantial portion of yield within client portfolios, whilst for those that didn’t need the yield it was reinvested in their portfolios. The outlook for equity income has altered and while it has not been eradicated, the return will be significantly reduced. However, our view on fixed income has taken a more positive stance.

Income opportunities for the multi-asset investor are not confined to equities and bonds - there are more options available to us: commercial property and alternative income such as infrastructure, renewable energy and social housing. Amongst these, commercial property has been the least resilient. Covid19 will likely only reinforce the demise of the retail sector and support the rise of logistics (the facilities needed to deliver online purchases).

Whilst working practices will change, trends that were apparent before Covid19 will continue. We have had a bias away from retail towards logistics for some time. Pricing over the short term has been disappointing, but it has also created opportunities and we believe this sector will continue to provide an attractive and reliable income stream. Alternative income has been a core component of our approach and this will continue. Availability based assets such as infrastructure and social housing have proved resilient in this crisis and for the most part their income streams have remained robust.

We are aware of client concerns with respect to their income; there are challenges, but we believe having more strings to our multi-asset bow will allow us to weather this income squeeze much better than a traditional asset mix.

James Calder

Research Director

The value of your investments can fall and you may not get back the amount invested. Past performance is not a guide to future performance. Please see our website for more detailed information and risk warnings. You should not invest in or deal in any financial product unless you understand its nature and we recommend you seek advice.

Compliance code: IO3480