Anyone playing chicken with your wealth?

3 OCTOBER 2017

Equity markets move in cycles, from pessimism at the bottom through to euphoria as they move ever higher when your average Joe (and pro!) feels like an investment god, before the eventual crash leads to despair as money is lost and pessimism reigns once again. As real return investors, our target is to create wealth by beating inflation plus an annual percentage and as our benchmarks have always risen, even when the stock market falls, it makes us sensitive to downside risk and managing the end of the cycle.

Investment management has been compared to dancing around a volcano because whilst everyone knows that it will eventually erupt, and that they will get burned, managers hope that they (and their investors) will be less badly burned than everyone else.

It strikes us that there are several ways to navigate the end of the cycle. The first is to ignore it which, as a passive strategy, is sound because over the long-term these losses have normally been recovered. This approach could suit those with long-term time horizons, who can stomach the volatility, and have the financial resources to ensure they don’t need to draw on the portfolio during any downturn. Our sense is that this doesn’t sound like most investors and is a very risky solution for those drawing an income from their assets.

Another approach is to rely on skill (or luck) and investment managers often suggest that their research and skill will help avoid investors avoid the worst of any downturn. This, in our view, is unlikely because if you leave the volcano’s edge early, your relative performance to the benchmark and your competitors suffers. To prevent this most houses now have limits on the amount of ‘benchmark risk’ managers can take. This is even worse in the institutional world due to the pressure to remain ‘first quartile’ and so managers keep risk on until the volcano erupts. This might seem irrational but as the performance benchmark falls with the market, losing the same or less than the index is considered as success. To us this feels like a great game of “Chicken” where the first to leave loses relative performance and the last to leave loses a lot of money.

Our preferred strategy is to systematically reduce risk as the cycle matures. Within any client’s mandate we can routinely flex risk up to 110% and down to 85% of the risk we need to deliver the target returns. Any moves beyond these parameters must be agreed by our Asset Allocation committee & Risk Team. We run above 100% early and mid-cycle when investment returns are strong and not generally lost at the end of the cycle. We then progressively reduce risk in the second half of the cycle down towards 85%.

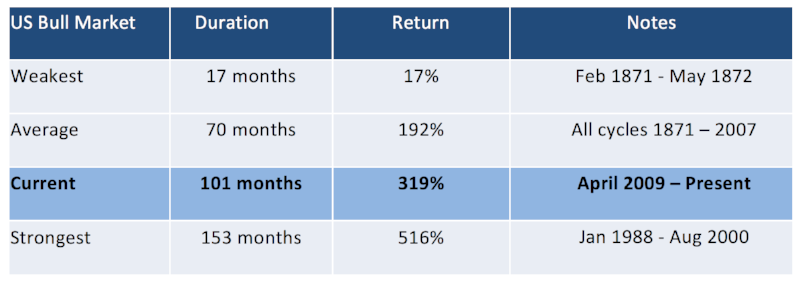

So how do we know where we are? We use a range of indicators, but we also cycle count and the table below shows the length and returns of all US bull markets since 1871 to the end of October 2017*.

*Source: Gestaltu.blogspot.com to 2009 & updated by City Asset Management to Oct 1st 2017

We have already reduced risk to 90% and taken some steps away from the volcano’s edge. There is generally a cost for security and in our case, we will underperform those managers who are still dancing around the crater, but the actual cost won’t be known until the other side of the cycle as many of the gains in the latter stages of a bull market are lost in the subsequent downturn. We already have an eye on the end of this cycle. What’s your plan?

Stephen Ford

Investment Director

This document may include forward looking statements that are based upon our current opinions, expectations and projections. Investment markets and conditions – and their applicability to participants in the industry – can change rapidly, and as such the views and interpretations expressed should not be taken as statements of fact, nor should they be relied upon when making investment decisions. We undertake no obligation to update or revise any forward-looking statements. Actual results could differ materially from those anticipated in the forward-looking statements.

Past performance should not be seen as an indication of future performance. The value of investments and the income from them can go down as well as up and an investor might not get back the amount originally invested and may be affected by fluctuations in exchange rates. The levels and bases of tax assumptions may change. NQ1790