Europe: From Sleeping Giant to Growing Opportunity

Max West summarises why our Research team believes that Europe is a Sleeping Giant and looks forward to higher returns in the future.

For the past 15 years, European equities have lagged far behind their international counterparts. This underperformance is striking given that the EU is the world’s largest trading bloc, accounting for around 20% of global GDP. Yet European stocks make up just 12% of the Global index. By comparison, the United States – whose economy represents roughly 25% of global GDP – commands nearly 70% of global equity benchmarks. This mismatch and sustained underperformance have earned Europe the nickname the 'sleeping giant’.

Several factors have contributed to this disparity. Europe has traditionally been seen as overregulated and bureaucratic, in contrast to the US entrepreneurial environment. The Eurozone has also been dealing with the after-effects of both the GFC and the Eurozone crisis. Corporate and governments reduced debt, impacting growth. By contrast, ultra-low interest rates, fiscal expansion and the emergence of some best-in-class technology stocks have spurred on the US market. The US market has performed exuberantly post the Covid pandemic. This divergence has left the US with far higher Debt/GDP and a clear performance gap in equity returns.

However, recent developments are shifting the picture in Europe. Fiscal attitudes are changing. This is most notable in Germany. After years of fiscal conservatism, the German government have created the scope for expansion. Confronted with years of industrial slowdown, prolonged economic stagnation and growing unease over dependence on US defence, Germany has announced a landmark €1 trillion package. The funds will modernise its defence capabilities and overhaul national infrastructure. The level of investment is unprecedented outside extreme recession.

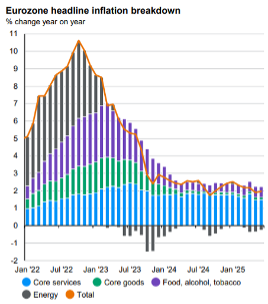

At the same time, Eurozone inflation is now more firmly under control than in the US or UK. Headline CPI has remained at or below target for three consecutive months. By contrast, both the US and UK continue to contend with elevated inflation. Consequently, the Eurozone is further along in its rate cutting cycle. The ECB has reduced its deposit facility rate eight times since beginning interest rate cuts in June 2024. Meanwhile, the Bank of England has eased rates five times, and the Federal Reserve four times.

Europe’s position as a major energy importer meant the surge in energy prices following Russia’s invasion of Ukraine hit particularly hard. But, with energy costs having come down, the Eurozone has benefited from this disinflationary tailwind.

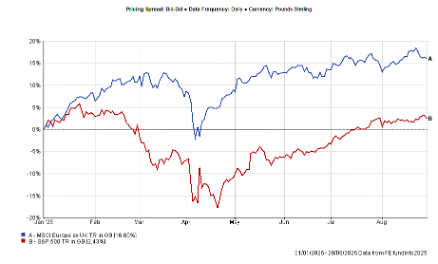

The first five months of 2025 reflected growing optimism toward Europe, with record inflows into European equities and notable outperformance vs the US. Since May, this performance gap has narrowed as investors rotated back into US markets amid greater clarity on US fiscal and trade policy.

We viewed the earlier rally in Europe this year as somewhat overbought, yet we remain confident in the region’s fundamental long-term setup.

Europe offers an attractive combination of factors:

· An agreed tariff deal with the US

· Cheaper valuations than the US

· Inflation firmly under control

· Low interest rates

· Fiscal expansion at a time when other developed economies are constrained by elevated budget deficits.

In line with this conviction, we have increased our European allocation twice in 2025, moving our portfolios to an overweight position in the region.

Max West

Max joined CAM as a Research Investment Analyst in 2024, having graduated from the University of Leeds with a BSc and MSc in Economics. He works with the research team and provides analysis to inform CAM’s investment decisions across asset classes. Max is currently studying towards his Investment Management Certificate, but also enjoys a variety of sports in his spare time.