The Bull Has Further To Run

Last January the FTSE 100 traded around 7,800 and commentators were observing that the world was enjoying a period of synchronized growth and further gains lay ahead. Over the next four weeks, markets fell and the FTSE 100 struggled to maintain 7,000 as we witnessed the return of volatility and our first 10% correction since 2015. After two years of tranquil, upwardly rising markets it is no wonder that for many investors this came as an unwelcome shock and naturally heralded calls of an end to the good times.

Regular readers will know that we are a cautious bunch due, in part, to our nature but also because we are chasing inflation-plus benchmarks which have never fallen in value. In this piece, we look at some of the reasons why we think this market has further to rise, despite our caution over valuations. The first and most obvious point is that at the end of any Bull market, valuations are expensive. Witness Bitcoin, a digital coupon with no intrinsic value that was ‘worth’ about $1,000 at the beginning of 2017 rose to $20,000 later that year and is currently valued at around $8,000 per coin. People forget that irrationality in markets can apply to both rising and falling markets.

So, have the fundamentals deteriorated? Not really in our view. The global economy is still enjoying a period of global growth although it was inevitable that we could not sustain the earlier higher percentage rates of growth. The problem for investors is that growth is coming off its previous highs at a time when interest rates are rising to combat inflation. These cross-currents are causing choppiness in markets and this could be a “Sell in May and go away, buy again on St Legers day” year. On balance, our sense is that global growth will prevail, and that solid company earnings will support the market. Whilst investors are rightly concerned about rising US inflation, our view is that the conditions for a recession do not exist and therefore the market can bear both higher interest rates and inflation.

Our views on markets were tested in February when markets fell by 10% and despite a potential nuclear conflict in North Korea, rising interest rates, rising inflation, trade wars, volatility rising 236% and 3 funds collapsing; all the sellers could do was push the market back by 10%. Subsequent buying pressure then lifted the UK market to trade at a new all-time high.

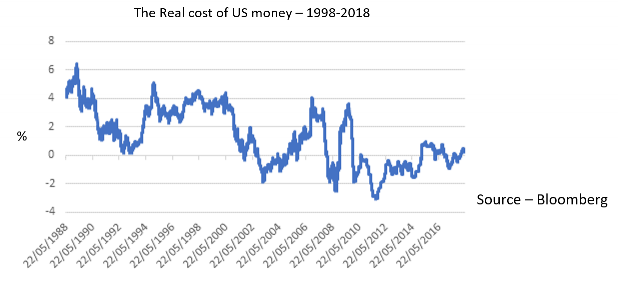

On interest rates it is the US capital markets that essentially sets the price of money for the world and investors seem to be obsessed with the ‘dangers’ of US bond yields passing 3%pa. We are always wary of such forecasts, which suspiciously cluster around whole numbers – why not 2.96% or 3.1%? One of the key drivers behind asset prices is liquidity i.e. how easy is to borrow money and at what price. Another way to think about interest rates is that it is the price of money – the more demand there is to borrow, the higher the price will be. Conversely, if the supply of money is expanded (we print more) or demand for credit falls, then so will the interest rate. Therefore, it is the Real cost (after inflation) of money that needs to be considered and when the cost of money is below inflation it is cheap because the loan will be eroded by inflation at a faster pace than the interest rate being charged. Furthermore, as wages normally rise by inflation the monthly repayments become more manageable over time. The chart shows that the real cost of money in the United States is barely above inflation and supports our view that the economy can bear higher interest rates.

In summary, we believe that the market has to work its way through these issues before resuming its final push upwards. This final leg up could last for several years, will see valuations become even more expensive, and just as with Bitcoin, it will be a rise to enjoy and sell into ahead of the ensuing downturn.

Stephen Ford

Director

This document may include forward-looking statements that are based upon our current opinions, expectations and projections. Investment markets and conditions can change rapidly, and as such the views and interpretations expressed should not be taken as statements of fact, nor should they be relied upon when making investment decisions. We undertake no obligation to update or revise any forward-looking statements and actual results could differ materially from those anticipated by any forward-looking statements.

Past performance is not a guide for future performance. The value of your investment can fall and you may not get back the amount invested.

Compliance Code FM1890