Bonds in 2024 and Beyond (Part 1)

ART OR SCIENCE

Investing is often referred to as an art or science. Compared with equity investing, bond investing falls more into the latter category; determining an appropriate price for any security is far more mechanical. This is particularly true for developed market government bonds, such as UK Government Bonds (‘Gilts’) and US Treasuries, especially if one assumes these bonds will be held to the bond’s end date (their ‘maturity’). Some research suggests that more than 90% of the total return (capital and income) ultimately delivered by defensive, high quality government bonds is determined by the starting yield (expected total return as a percentage of the bond’s price) investors know at the outset. The ability of investors to use a single valuation measure to determine future returns drops significantly for other asset classes such equities. This is especially true in the short to medium-term.

NO FREE LUNCH

This relative certainty of outcome in government bonds surely results in a smooth ride for investors. Not so fast. The stronger relationship between bond yields and realised return is not without its own drawbacks during the holding period. As the chart below shows, an investment in longer dated Gilts on 1 January 2022 would have experienced equity-like volatility and lost -12.4% to the end of September 2023.

The driver of price volatility during this period is the change in market expectations for growth and inflation. This forced the Monetary Policy Committee at the Bank of England (BOE) to hike the Base Rate from 0.1% in December 2021, to 5.25% by July 2023. The price of long dated Gilts have relatively high sensitivity to changes in interest rates (high ‘interest rate duration’). Therefore, in this rising rate environment, the best protection for an investor, would have been to buy shorter maturity bonds (thereby reducing interest rate duration). We are happy that these assets, which were added to client portfolios at the start of 2022, have helped cushion some of the volatility over the last two years. However, the question before us today is, what is the most appropriate positioning going forward?

THE MACRO ENVIRONMENT

Coming into 2022, the market was clearly expecting higher interest rates given the spike in post-pandemic inflation. Central banks obliged and delivered significantly more interest rate hikes than were expected (and were priced in by the market) during 2022 and 2023. As the chart below shows, expectations for interest rates have reduced substantially since peaking in the third quarter of 2023. Expectations now are for the base rate to fall to around 3.3% within the next 24 months. This is based on the expectation of sharply lower inflation. In fact, UK inflation that was running at over 8% (year-on-year) as recently as September 2023, is expected to fall below the BOE’s target of 2% by the middle of this year. It is then anticipated that inflation will recover to between 2% and 3% by year end and into 2025. This change in inflation environment is a function of two factors. Firstly, the sharp price increases seen between 2021-2023 rolling out of the CPI calculation (known as ‘base effects’). And, secondly, a slowing economy as the impact of higher interest rates begins to strangle growth in earnest. This same phenomenon is playing out across other major markets globally to a greater or lesser extent, as shown below in the outlook for rates across key regions:

These outlooks are not presented as fact. We agree with the market that interest rates should end 2024 below where they are now across most if not all markets (positive for bond returns). However, the range of outcomes remains relatively wide in the short-term. Longer term inflation expectations have also subsided (good for longer maturity bonds), although greater uncertainty exists around these expectations as well. The future is always uncertain (hence why we believe in a diversified multi asset approach). Therefore, we continue to be positioned for multiple scenarios, with the expectation that an increase in the frequency and size of movements in the price of bonds (versus the last decade) lies ahead for investors.

DEFENSIVE BONDS - BEST CASE POSITIONING

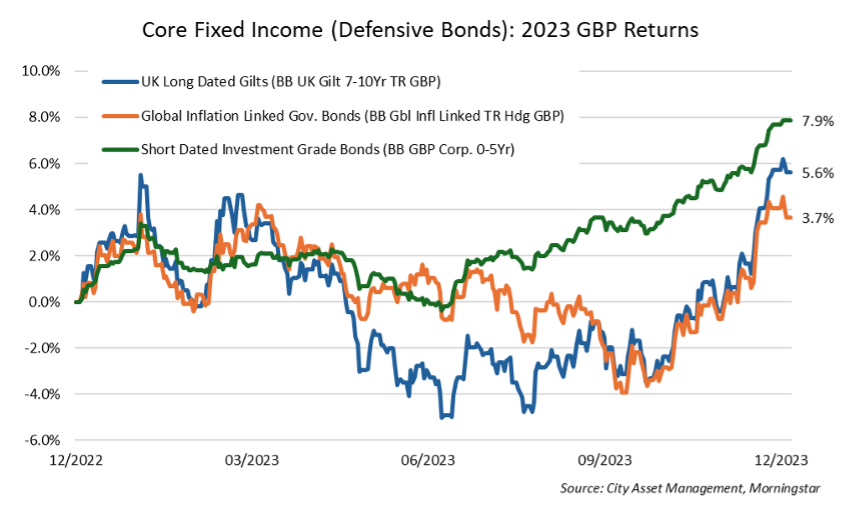

Considering the direction of travel for short-term interest rates, and the longer-term inflation outlook (which we expect to be higher in the coming decade versus the 2010s), we see a strong case for the Defensive Bond in portfolios. Below we briefly discuss all three components of our Core Fixed Income bucket.

Nominal (Conventional) Government Bonds

As highlighted above, global economies are slowing, and this is accompanied by lower inflation. We expect inflation to be more volatile going forward. However, in the very short term, our expectation is that inflation will slow enough to give most central banks the confidence to begin cutting interest rates. The size of these cuts will depend on the state of each economy (i.e. how much growth slows). In a slower growth environment, these cuts may be anything from 2% (i.e. a recession is avoided, or what is being referred to in the media as a ‘No-landing’ scenario), up to 5% in a ‘hard-landing’ scenario (i.e. the economy enters a potentially deep recession).

Looking at current data, we see a high probability that both the UK and Europe are likely to experience an economic contraction, while the US has the greatest probability of avoiding a recession. Our base case is not for a deep recession in any of these markets, but the weak growth outlook suggests that longer-maturity bonds (yes, the ones that were so volatile in 2022 and 2023) are looking more attractive. The starting yield today on the UK 10 Year Gilt is 3.9% (versus 0.97% in January 2022). This is well above our expectation for UK inflation over the long-term, implying these assets should (with a reasonable probability) deliver inflation beating returns if we hold them to maturity. Additionally, if we are wrong and there is a deeper recession in the UK and steeper interest rate cuts are warranted, the defensive bond characteristics that were missing the last two years should return to provide ballast to portfolios.

Inflation/Index Linked Government Bonds

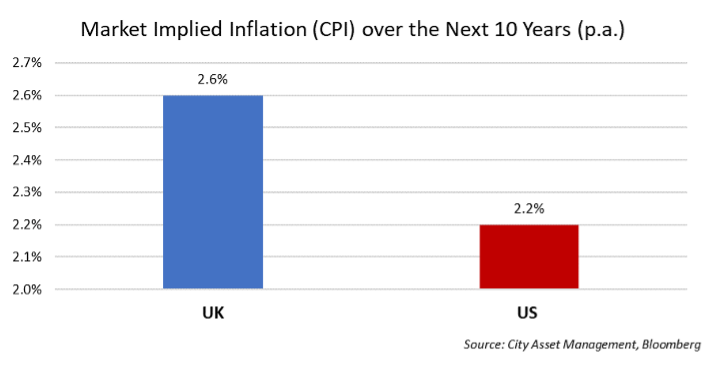

The attractiveness of the potential real return (i.e. return above inflation) from government bonds extends to Index linked government bonds (both UK index-linked Gilts and US index linked treasuries (TIPS)). We look at the relative value between these two different government bonds regularly. While Implied inflation is higher in the UK than the US, they still offer positive real yields for the first time since the mid-2000s. In the US, a comparison between conventional US Treasuries and TIPS shows that inflation only needs to average above 2.2% p.a. over the next 10 years to make US TIPS a better investment. The inherent inflation protection is an additional attractive characteristic given the higher probability of ‘spike-flation’ going forward (short periods during which inflation increases significantly, before falling again quickly).

Some investors may point to higher yields on short maturity bonds versus long maturity bonds as an argument for cash as the safest option for investors. There is a scenario in which cash and short maturity bonds continue to outperform. However, our view is that this will be short-lived and the longer your investment horizon, the lower the probability this will prove to be a superior strategy. Given this change in expectation for inflation and interest rates, re-investment risk comes into play. This is the risk that the regular interest received from government bonds in the future will need to be re-invested at a lower rate. Since we first reduced the risk of long maturity bonds in favour of short maturity Gilts in early 2022, reinvestment risk in considering investments of cash and short-dated bonds has increased substantially. We are constantly debating the optimal allocation within our direct government bond exposure as these securities mature (i.e. capital is returned) and needs to be re-invested. As a team, we seek consensus at a high level. This ‘house view’ is then implemented on a client-by-client basis given individual client circumstances to ensure that we deliver a bespoke solution for you. Factors that influence decision making include income requirements, taxation, risk tolerance and investment horizon.

Short Dated Investment Grade (Corporate) Bonds

The final sub asset class in our defensive bond bucket is not government debt, but the short maturity bonds of higher quality companies. We mostly access these assets via funds, given the superior diversification and potential additional return from 3rd party specialist managers). Corporate bonds have performed exceptionally well during this very difficult period. In fact, this was the best performing component within Core Fixed over the last 12 months.

With current yields around 5.5% to 6% these assets appear fairly valued. We also believe that they are well positioned to produce returns close to their starting yields over the medium-term (2-3 years) in many different economic environments. A more significant economic slowdown will see greater volatility in these corporate bonds. Therefore, security selection will be important in determining the performance delivered by these strategies in a recessionary environment. However, the shorter maturity and higher quality of the companies whose bonds are included in these strategies are expected to prove robust. History suggests through the cycle that exposure to these assets provide a consistent return uplift, versus government bonds with similar maturities.

WHERE TO THEN FROM HERE?

Our investment process is not designed to aggressively throw your capital around. In particular, the allocation within our Core Fixed Income bucket targets appropriate diversification across the three sub asset classes. Given the economic environment over the last two years, we have been more active in managing the sensitivity to interest rates. We have done so directly via Gilt investments – a nimble and cost-effective means of implementation. This has served our clients well and we will continue this strategy, for as long as it remains the most efficient way to do so.

In terms of return expectations, it is easy to be optimistic. Starting yields on the defensive bonds discussed above have proven to be good predictors of future returns for those willing to accept some volatility over the short-term. For the first time in a long while we are confident these bonds will not only serve as ballast to the growth assets in portfolios but will help achieve the long-term real return targets across mandates. This bodes well for risk-adjusted performance in the coming years. We believe that multi asset investing will again prove an appropriate approach in what may be a different macro environment.

This article was prepared by Dean Barnard, one of our Senior Investment Analysts. We always appreciate your feedback. If you have enjoyed this article or have any specific topics you would like to see addressed in future newsletters, please email us.