2022: a taxing year

Who could forget Kwarteng's now infamous 'Growth Plan' from September last year. After a terrible reaction from the markets, most of the proposals put forward suffered the same crash-and-burn fate as their proposer within weeks. The flip-flopping on policy may have left you confused, so we have prepared a quick summary of the tax changes that might impact you.

Quiz time

To begin, a simple quiz of the year. In 2022:

How many Prime Ministers were there?

How many Chancellors graced 11 Downing Street?

How many Budgets were presented by those Chancellors?

The first question is easy enough – three: Boris Johnson, Liz Truss and Rishi Sunak. The second is more challenging – four: Rishi Sunak, Nadim Zahawi, Kwasi Kwarteng and Jeremy Hunt. The third question falls into the trick category – none. There was an abundance of statements from the various Chancellors over the year, but not one member of the quartet produced something that was formally labelled as a Budget. The last official Budget was in late October 2021.

You could be forgiven for thinking there was at least one Budget, as much of the media commentary ahead of the Autumn Statement made by Chancellor #4 referred to a forthcoming Budget. While it was not Budget-branded, the Statement’s financial impact was greater than many a genuine Budget. To complicate matters more, the Autumn Statement arrived a little under two months after another non-Budget, Kwasi Kwarteng’s ‘Growth Plan’. In the time between the two events, most of the Growth Plan proposals suffered the same crash-and-burn fate as their proposer.

Where are we now?

The flip-flopping on policy may have left you confused, so a quick tax summary may be of help:

Income tax: The personal allowance and the UK-wide higher rate threshold will be frozen at the 2021/22 levels (£12,570 and £50,270 respectively) until the end of 2027/28 – two years longer than previously planned. Had indexation been applied, in 2023/24 the personal allowance would have been £14,280 and the higher rate threshold £57,800.

The UK-wide additional rate threshold will fall from £150,000 (frozen since 2010/11) to £125,140 in 2023/24. That odd figure was carefully chosen to match the ceiling of the income band (£100,000 - £125,140) in which the personal allowance is tapered to zero.

Dividend tax: In 2023/24, the dividend tax rates above the dividend allowance will remain at 8.75% (basic), 33.75% (higher) and 39.35% (additional). However, the dividend allowance will halve to £1,000 in 2023/24 and then halve again to just £500 in 2024/25.

National Insurance Contributions: The 1.25 percentage point increases to all the main national insurance contribution (NIC) rates that took effect at the start of 2022/23 were scrapped from 6 November 2022. The main NIC thresholds will be unchanged in 2023/24.

Capital gains tax: The annual exempt amount will be cut from £12,300 this tax year to £6,000 in 2023/24 and then just £3,000 in 2024/25. Thereafter, indexation will no longer apply.

Inheritance tax: The inheritance tax nil rate band and residence nil rate band will be frozen at their current levels (£325,000 and £175,000) until 5 April 2028.

Corporation tax: The rate increases announced in 2020 will go ahead, making the main corporation tax rate 25% from 1 April 2023. For companies with profits below £250,000, a 19% rate will apply to the first £50,000 and 26.5% on any balance.

IR35 reforms: The 2017 and 2021 reforms to IR35 (also known as the rules for off-payroll working) will not be wound back. The changes to corporation tax rates and the dividend allowance have also reduced the relative tax-efficiency of operating via a one-person company.

On the non-tax front, probably the most important announcement was on energy price support, From April 2023 the Energy Price Guarantee, which caps utility providers’ rates (not the total cost) for domestic electricity and gas, will increase from £2,500 to £3,000 a year for the following twelve months. There was no suggestion that the existing £67 a month support payment to households would continue beyond March 2023. For non-domestic consumers, the message was not as helpful. When the existing Energy Bill Relief Scheme ends in March there will be no replacement, although some (so far unspecified) targeted support at those most affected is promised.

What are the effects?

The short answer is that, over the coming years, you will see more of your income and capital gains disappear in tax. The freezing of the personal allowance will eventually lead to an extra 3.2 million people being dragged into tax compared with what would have happened under indexation. By 2027/28, the personal allowance will have the same real (inflation-adjusted) value as it had in 2013/14 according to calculations from the Office for Budget Responsibility (OBR).

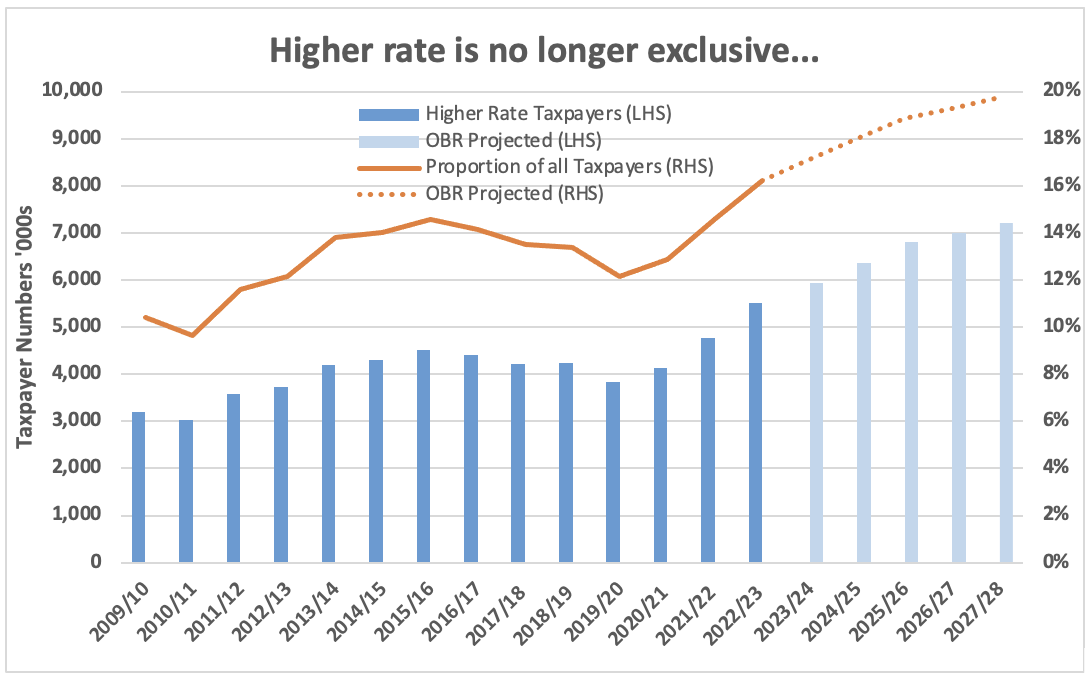

The higher rate taxpaying population will rise by an extra 2.6 million by 2027/28. As the graph below shows, by 2027/28, about one in five of all income tax payers will be higher rate, more than double the level of 2010/11.

Additional rate taxpayer numbers will jump by 232,000 in 2023/24, because of the reduced threshold.

Even if you avoid being pushed into the next tax band, you may still be caught by the 75% cut in the dividend allowance. HMRC estimate that nearly three out of four recipients of dividend income will be ‘affected’ by 2024/25. It is a similar story with capital gains tax (CGT), with another half a million CGT payers being created.

Source: HMRC, OBR

One collateral effect of the dividend and CGT changes is that you may find you have more dealings with HMRC because you become a dividend tax and/or CGT payer. At worst, you could find yourself having to complete a self-assessment return as there is no other way to report capital gains that exceed the annual exemption.

Action: The message from 2022 is that tax cuts are firmly off the agenda, as the financial markets made clear in response to Mr Kwarteng. If you want to see your tax bill come down, do not look to the Government.

To understand more about how the announcements in the Autumn Statement will affect you and what action you can take to ease the growing tax burden, talk to us now. We can then integrate proposals into your tax year end planning.