Rethinking Retirement Plans

The March 2023 Budget contained two announcements which could alter your retirement planning strategy. The first, an increase in the annual allowance, was not a great surprise, as the Chancellor had been under growing pressure to alleviate pension tax issues for NHS consultants. The second, a two-stage abolition of the lifetime allowance, was totally unexpected.

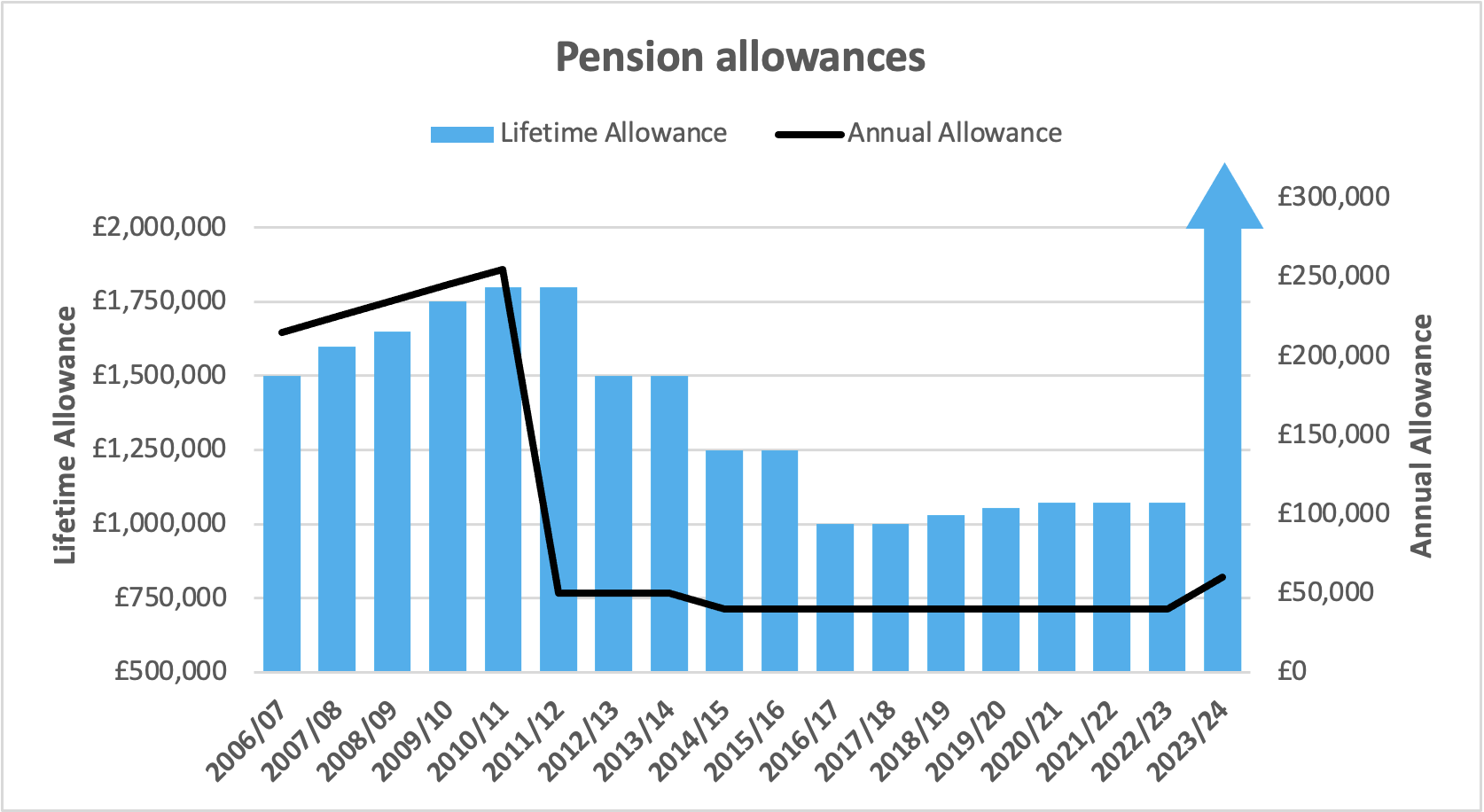

Source: HMRC

The annual allowance increase

Broadly speaking, the annual allowance sets the maximum tax-efficient total contributions during a single tax year to all your pension arrangements from all sources. As the graph demonstrates, it was sharply cut in 2011/12 and cut again three years later. The 2023 Spring Budget raised the maximum annual allowance from £40,000 to £60,000 from 6 April 2023. However, the important word to note here is ‘maximum’, as the complex rules that taper the annual allowance for high earners remain in place, albeit the minimum tapered annual allowance also increased, from £4,000 to £10,000.

A £6,000 increase to £10,000 also applies to the money purchase annual allowance, which restricts your contributions if you have used the pension flexibility rules to draw a taxable benefit.

The lifetime allowance changes

The lifetime allowance was a parallel limit to the annual allowance, setting the maximum tax-efficient value of all pension benefits. It too suffered cuts and freezes from 2011, although each cut was accompanied by transitional protections, complicating the pension tax regime further. While there had been calls for the lifetime allowance to be scrapped because the annual allowance was arguably a sufficient restriction, nobody expected such logic to prevail. When it did, it appears to have surprised even the Treasury.

The proof of that emerged in the various explanations of the changes which the Treasury produced in the weeks after the Budget. What appeared on Budget Day to be an outright abolition on 6 April 2023, later proved to be:

The lifetime allowance remains in the pension legislation for the time being, but

For 2023/24 there is a reduction in the rate of the lifetime allowance tax charge to 0% from the previous 55% for lump sums and 25% where funds were used for income. However,

For certain lump sums, the lifetime allowance charge has been temporarily replaced with an income tax charge before

Full abolition takes effect from 6 April 2024. It is not clear whether this will be achieved by next year’s Finance Act or later legislation.

The need for review

In theory, the Budget changes could mean that a handful of higher earners who had long given up on paying into a pension could arrange pension contributions of £180,000 in 2023/24, taking advantage of the carry forward rules for three previous tax years of unused allowances.

In practice, how much you can benefit from the allowance changes is dependent on your individual circumstances and retirement goals. The Shadow Chancellor, Rachel Reeves, has said the lifetime allowance would be reintroduced if the Labour Party wins the next election, however, that would reintroduce complexity into the system and there may not be an appetite to do it.

Navigating changes – and potential changes – in pension tax law requires expert advice. It can also take considerable time, given the data that may be required from a range of pension providers. If you want to explore the impact of the Budget changes on your retirement planning, contact us as soon as possible so that the process can begin.

This article was prepared by Chris Green, our Head of Financial Planning. We always appreciate your feedback. If you have enjoyed this article or have any specific topics you would like to see addressed in future newsletters, please email us at FPTeam@city-asset.co.uk.