NOVEMBER 2025

Strong Long-Term Performance Against a Challenging Backdrop: Aberdeen Emerging Markets Income

Aberdeen Emerging Markets Income was introduced to portfolios at City Asset Management at the start of 2025. Emerging markets have had a stellar run so far this year and Aberdeen has been a strong performer in both absolute and relative terms, up over 30%.

The strategy is managed by one of the largest and most experienced teams in the sector. Matt Williams, the lead Portfolio Manager, has been involved in the fund since 2012 and took over as lead manager in 2018. Matt is supported by over 50 analysts located in 7 global offices.

The philosophy that underpins the strategy is the belief that by paying dividends, companies stay focused and are less wasteful with their capital allocation. Paying dividends also prevents companies competing for market share at any cost which the team do not feel is a desirable characteristic. The team are very focused on balance sheet strength, strong free cash flow generation and transparency. They believe this combination leads to companies with more sustainable dividends and a lower probability of dividend cuts.

The process is shown below. There are two main groups the team allocate to; dividend growers and high dividend stocks, with a small sleeve left for special situations (extreme opportunities that arise from market dislocations). This adds to the diversification of the strategy and robustness of the income payments we receive.

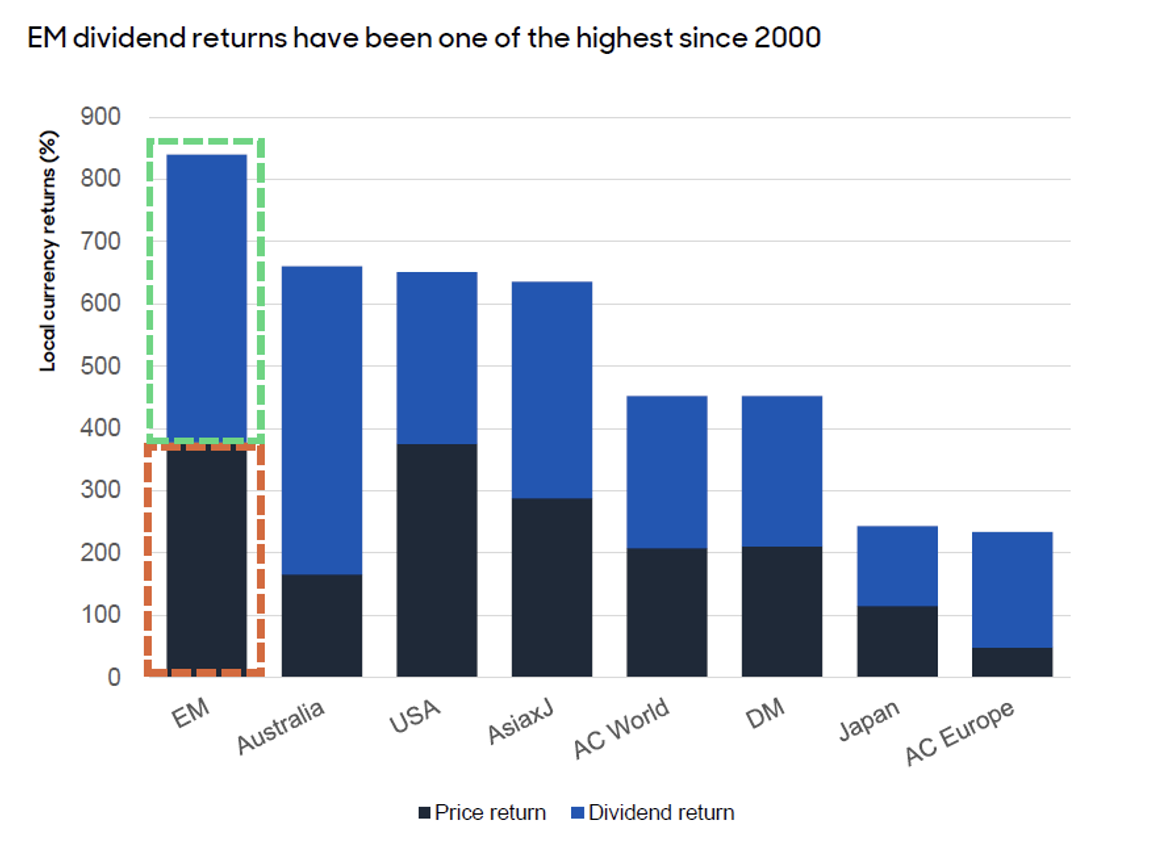

There is strong evidence to support the use of an ’income’ approach in emerging markets. From 2000-2024, 50% of the returns in emerging markets were delivered via dividend payments. Despite strong capital appreciation in Emerging Markets this year, we continue to like the case for income in the region. We believe starting with a dividend yield of 4% (as you are in this fund) meaningfully adds to total return and helps to protect when markets sell off. Several countries, including China and South Korea, are embarking on programmes to increase returns for shareholders, and one way this is being facilitated is by increasing dividends. Increasing payout ratios (the percentage of company profits being paid out as a dividend) is an encouraging sign for income strategies, as the yield investors receive from companies is rising. There is still a long road ahead to close the gap with developed markets, which is another tailwind for this fund’s approach.

Aberdeen gives us a wide range of access to different countries and sectors across the entire Emerging Market region where they have deep expertise. We believe this fund is a good bellwether; what we mean by this is that the fund should perform in all market cycles. Where it may underperform its benchmark is when we are in environments when speculative/go-go growth companies lead (as was the case in 2016 and 2020 with Chinese technology, unprofitable and profitable in the latter). We are comfortable with this and believe that the ability of this fund to compound and grow dividends and earnings over the long term sets it up for success.

The long-term performance also shows that the diligent process Matt and his team follow has worked. We observe that this performance has been achieved in a tough period for Emerging Markets, with the main difficulty facing the region being US Dollar strength. Dollar cycles tend to work in 10-year periods and, after 13 years of dollar strength, 2025 has so far been a year of weakness. This benefited the asset class and, if this continues, we believe this will provide significant support to the performance of Emerging Markets generally.

This commentary was prepared by the CAM Research Team.