SEPTEMBER 2025

A diversified portfolio of social and public infrastructure: INPP

The asset class we call Alternative income forms a core pillar of our multi-asset strategy. These are investment companies that manage diversified infrastructure portfolios, valued for their resilient demand, inflation linkage and government-backed revenues. Within this space, INPP stands out as one of the largest and most established names, with a long track record and membership of the FTSE 250. Its portfolio spans a broad mix of social and public infrastructure that is essential to the functioning of society.

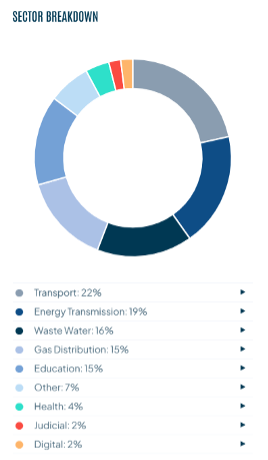

INPP is well diversified across sectors, holding more than 140 investments. While the majority are in the UK, the portfolio also spans Europe, North America, Australia, and New Zealand.

Around half of its value is in regulated assets overseen by independent bodies such as Ofgem. These assets are particularly attractive because they generate stable, predictable revenues that are insulated from direct market competition, thereby reducing demand risk. They also provide long-term visibility and income streams that rise with inflation.

A prime example is Cadent, the UK’s largest gas distribution network. Cadent is one of INPP’s largest holdings, and it supplies energy to around 11 million homes and businesses. INPP also owns 11 offshore electricity transmission assets, which play a critical role in connecting offshore wind farms to the onshore grid.

INPP has recently been appointed the preferred bidder for the Sizewell C nuclear power project in Suffolk. While construction is expected to continue into the late 2030s, the company will, in the interim, receive attractive compensation, delivering an internal rate of return in the low teens. Once operational, Sizewell C is projected to generate around 7% of the UK’s electricity supply, playing a significant role in supporting the country’s transition to cleaner energy.

INPP currently offers an appealing income yield of 7.1%. Since its launch in 2006, the trust has delivered an average annual dividend growth of around 2.5% and expects to maintain this pace in the years ahead. Combined with the potential for capital appreciation, this creates a compelling total return profile for investors.

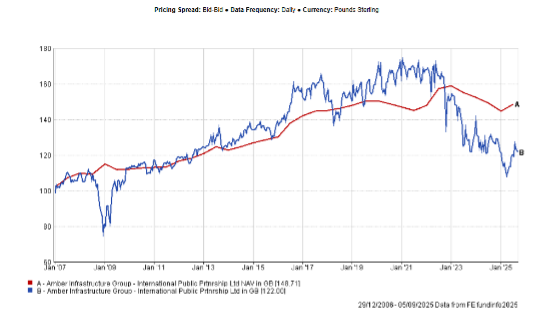

One of the main risks to consider with INPP, and with the Alternative Income sector more broadly, is the potential gap that can open between the share price and the value of the underlying assets. The infrastructure projects that INPP owns are physical, long-term assets that cannot be bought and sold on a daily basis. To give investors access, INPP is structured as an investment trust. This means investors are purchasing shares in the trust, which in turn holds the assets.

That creates two numbers to keep in mind: the share price (what the market is willing to pay for INPP shares at any given point in time) and the Net Asset Value, or NAV (the assessed value of the underlying infrastructure assets). Normally, the share price and NAV track closely together. However, in recent years, higher interest rates and weaker sentiment in the sector have pushed INPP’s share price down to trade at roughly a 20% discount to NAV. In other words, the market price is about a fifth lower than the value of the assets. This stands in contrast to the period prior to 2021, when INPP shares almost always traded at a premium to NAV.

We view the current discount as a compelling entry point. While the precise timing of a recovery is uncertain, we believe that over the long term INPP’s share price should move closer to the value of its underlying assets, offering scope for both income and capital growth.

For us, INPP exemplifies the role of alternative income within a diversified, multi-asset strategy. Its inflation linked revenues, essential infrastructure exposure, and strong yield profile complement traditional equities and bonds. The current discount presents an opportunity for patient investors. In our view, allocations such as this trust strengthen portfolio resilience and INPP will remain a core holding within our multi-asset portfolios.

This commentary was prepared by the CAM Research Team.