2025 Recap

As we lived through it, there’s no need to rehash the shared experience – but if I were to sum up the year in one word, it would be “Trump”. Love him or hate him, he has made his mark on markets and macro-outcomes. Liberation Day generated a tougher reaction than I expected, and markets rightly reflected that uncertainty; the dust has since settled.

Inflation outcomes, specifically who ultimately pays for tariffs (importers or consumers), remain unresolved, though it would appear both parties have borne costs.

Market performance was solid:

Broad returns were positive, and our client mandates reflected this.

The Magnificent Seven (and AI more broadly) had a wobble early in the year before sentiment recovered.

US markets, in local currency terms, proved buoyant.

Despite ongoing macro challenges, performance finished stronger than I had envisaged at the start of the year.

UK large-cap performed well.

Outperformance of Rest of World equity markets vs US (for sterling investors).

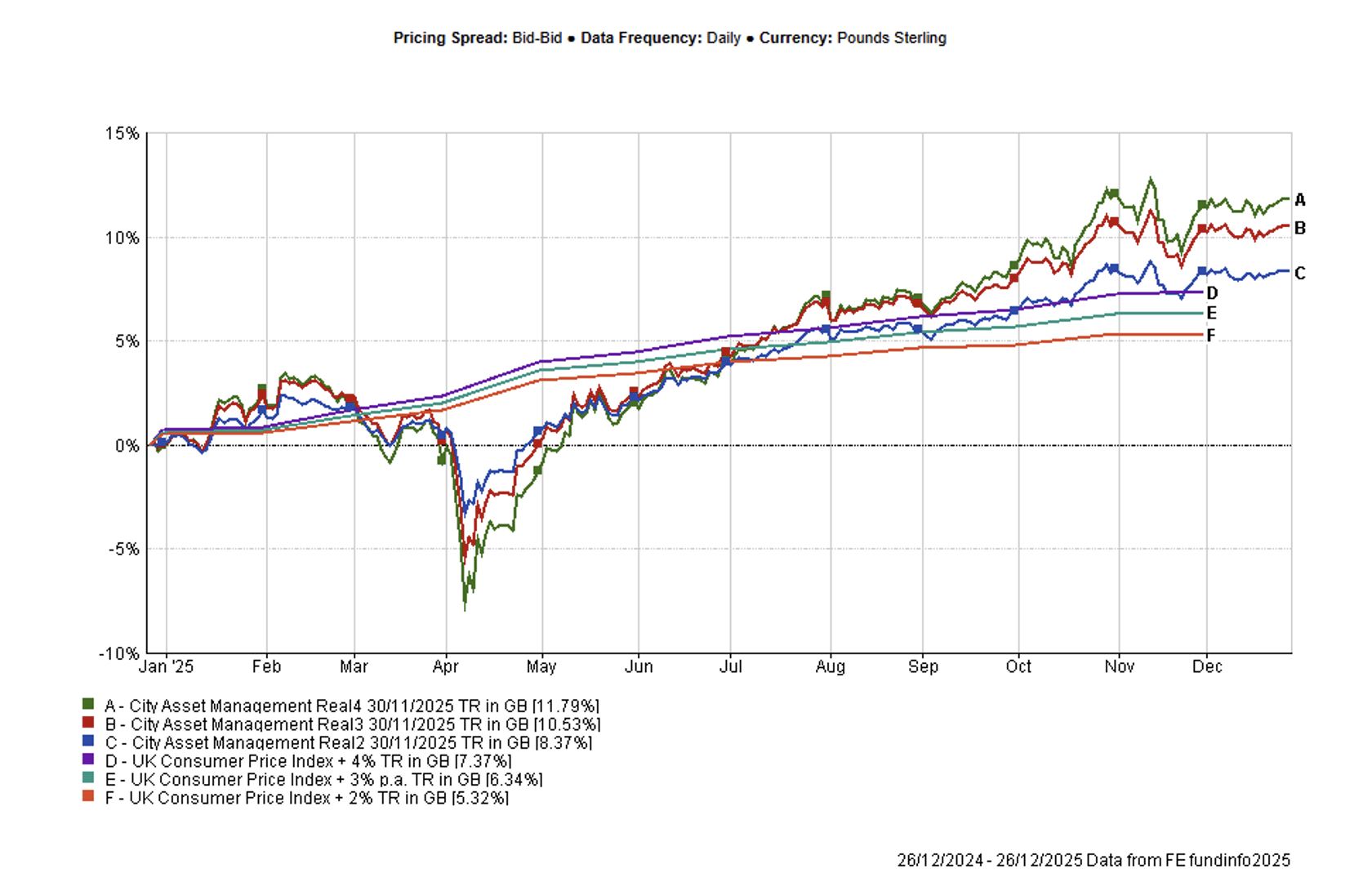

We faced headwinds, notably frustrating corporate behaviours in the closed-end fund universe, but overall, it was a respectable set of returns. The chart below reflects the usual caveats; inflation returns lag, and the MPS performance is presented gross of all fees except fund fees.

Below are key themes and my own predictions for 2026:

Equities

US Exposure

Our underweight to US equities has been driven by valuation concerns, even as exposure remains diversified.

Consensus commentary on 2026 often describes US markets as ‘rich’, particularly AI-heavy sectors, but strategists remain, on balance, optimistic for continued returns. A key factor is that US recession risk is generally viewed as low over an 18-month horizon. Recent market outlooks from major global banks support resilient equity performance. This is driven by AI capex, supportive fiscal policy, and solid corporate balance sheets. Some forecasts even envisage double-digit equity gains across developed and emerging markets in 2026.

US mid-term elections in November will characterise the political backdrop. President Trump’s imperative to avoid a ‘lame duck’ period could mean policies that sustain near-term economic momentum. These may include keeping the economy running hot and the Federal Reserve inclined toward accommodation. This is positive for equities in the short term, though it may come at the expense of long-term economic health.

AI and Bubble Dynamics

AI investment has been a central driver of markets. While corporate cash flows have financed much of this capital expenditure (’Capex’) to date, bond markets are increasingly providing funding. Yet bond investors do not care about growth narratives; only repayment and coupon.

The risk scenarios are real: if monetisation fails, expected efficiency gains disappoint, China produces superior, cheaper alternatives, or Capex spirals out of control, we could see a sharp repricing event. Institutional forecasts emphasise that AI remains a structural growth driver, though some analysts warn of valuation excess and concentration risks that could amplify volatility if sentiment shifts.

If a correction occurs, correlations could spike sharply, contagion could spread, and then cash-generative businesses could re-emerge as market favourites.

Emerging Markets and Asia

Asia and Emerging Markets outperformed in 2025. Research will provide more detailed views on these regions, and Japan, but early indicators suggest China’s fiscal and economic policy is becoming more proactive in 2026, with a focus on boosting domestic demand and innovation. Supportive policy could underpin growth, though rebalancing from export-led models remains ongoing.

Inflation and Rates

United States

Inflation remains sticky in the US, complicating the Fed’s policy calculus. Consensus forecasts see inflation moderating but remaining above pre-pandemic norms. Political pressures may further complicate monetary policy independence in 2026.

Fiscal policy (e.g., tariff rebates or tariff-related checks) could buoy consumption and growth, a theme highlighted in broader risk frameworks for the year.

Europe

The Eurozone has inflation better contained, and the European Central Bank (‘ECB’) is expected to balance pro-growth policy with inflation control. Trade and monetary policy divergences will remain key drivers of market outcomes.

United Kingdom

UK inflation is falling, though the 2% target remains elusive. With the recent Bank of England rate cut bringing the base rate to 3.75%, further easing in 2026 may be limited to around 50bps. Structural challenges in the UK economy persist, and political uncertainty remains elevated.

Recent news highlights that from the end of 2026, UK carmakers may face up to 10% tariffs on EV exports to the EU. This impacts industrial competitiveness and potentially creates inflationary dynamics.

The possibility of government changes to the leaders at both No.10 and No.11 reflects lingering economic mismanagement sentiment; either outcome could lean toward higher taxes and policy instability, not more fiscal prudence. Either way, the UK budget will be characterised by further tax rises. Spending will remain high, leading to a weak fiscal position, but the UK is a long way off calling in the IMF.

Churchill’s quote remains apt: “For a nation to try to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle.”

Fixed Income

If equities continue to perform, should we worry about the bond market? Most forecasts see fixed income returns enhanced by the higher risk-free rate post-2020, though duration exposure and curve positioning require vigilant oversight.

Some multi-asset credit managers are shifting toward government bonds, suggesting a reassessment of risk/return in credit markets.

Our approach traditionally delegates much of this to managers with tactical flexibility. However, if the fixed income bucket expands, we will consider the merits of selective mandates versus broad mandates.

Alternatives and Diversifiers

Benchmarking alternatives remains challenging, especially outside direct property. Exposure may decline as infrastructure and renewables books wind down. I would suggest reconsidering nomenclature – ‘Diversifiers’better reflects intent than ‘Alternatives’.

We are evaluating hedge-like strategies where the return profile and liquidity terms make sense, and we have added the Cohen & Steers fund to our BUY list. This, alongside select infrastructure holdings (e.g., HICL, INPP) and alternative income funds, could form a coherent diversifier sleeve.

Given our nimbleness and size, specialist closed-end mandates are worth continued exploration. Research will prioritise ideas with a high bar for inclusion.

High-Level Predictions for 2026

Peace in Eastern Europe becomes more likely, though trust with Putin remains fragile.

Oil and Gas prices may correct lower, absent major supply shocks.

Stagflation fears will persist, though inflation is generally moderating.

Equity markets should deliver respectable returns in H1 2026.

AI valuation worries will continue to headline risk screens.

China avoids policy missteps and begins to deliver tangible domestic demand momentum.

An America First agenda remains in place, but the worst shocks are behind us.

A global recession is avoided, though growth undershoots targets and unemployment rises modestly.

UK rates fall more aggressively than consensus predicts.

Finally, on the lighter side, in recognition of a spirited but unlikely scenario: Scotland beats England 7–3 in the World Cup final (in normal time).

Closing Thoughts

What matters most is that we are clear on our assumptions, cognisant of risks, and aligned in our convictions. Because right now, it’s not that bad out there.

James Calder, Chief Investment Officer

James joined City Asset Management in 2009 and is our Chief Investment Officer, where he is responsible for managing the investment process and chairing the asset allocation, portfolio construction and fund selection committees. He is also a member of the Executive Committee . He has over 25 years’ experience, including roles at Gartmore, BestInvest and Baring Asset Management, and specialises in multi-asset real return investing. Throughout his career he has been a key mentor for younger analysts and enjoys watching them progress on to their own successful careers.