Sustainable Investing: 2025 Review

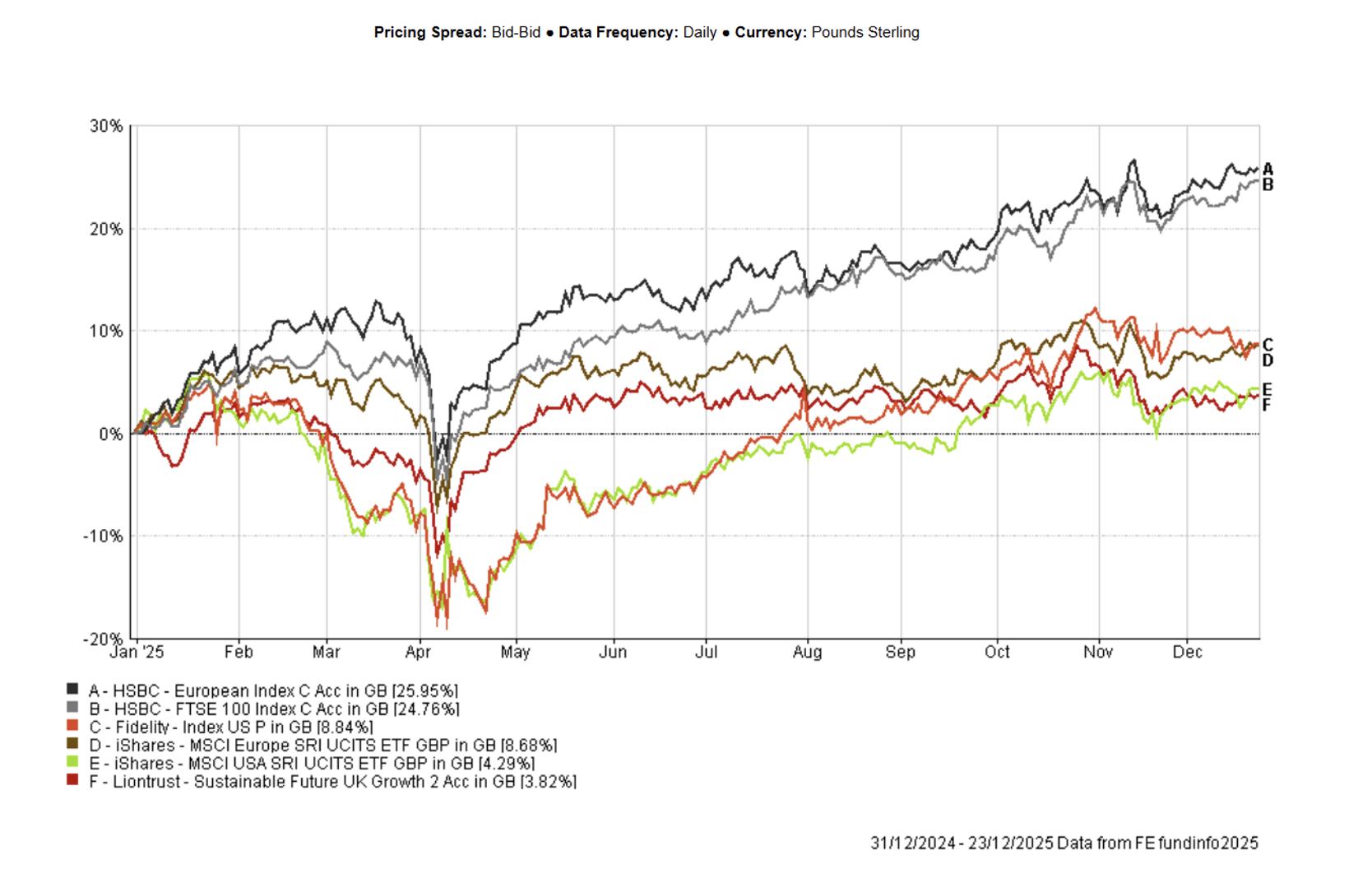

2025 proved to be a challenging year for sustainable investment strategies. Mandates that emphasise Environmental, Social and Governance (‘ESG’) factors, an assessment of how companies manage environmental impact, social responsibility and corporate governance, operate within a more constrained investable universe by design. Entire sectors, such as oil & gas, mining, commodities and parts of heavy industry, are often excluded or significantly underweighted. As a result, when these sectors perform strongly, sustainable strategies are structurally disadvantaged and may lag traditional benchmarks.

In addition, ESG criteria tend to create a consistent quality growth bias within sustainable portfolios. The emphasis on strong governance, transparent reporting, sound balance sheets and stable management teams naturally favours higher-quality companies, while filtering out more cyclical, highly leveraged or lower-quality businesses. Traditional value sectors such as energy, utilities and heavy industrials typically score poorly on ESG metrics, reinforcing a growth tilt within sustainable funds.

Many ESG investors seek to engage with companies to improve their sustainability practices. This is often more feasible with mid-cap businesses, which are large enough to have formal ESG frameworks in place, yet small and flexible enough to adapt and improve. Large, established companies can be slower or more resistant to change, while smaller companies often lack sufficient ESG disclosure or governance structures. As a result, mid-cap stocks frequently represent the ‘sweet spot’ for sustainable mandates.

Against this backdrop, 2025 has been close to a perfect storm for sustainable investing. Traditional mandates have outperformed their sustainable counterparts across major developed markets, including the UK, Europe and the US.

Source: FE Analytics

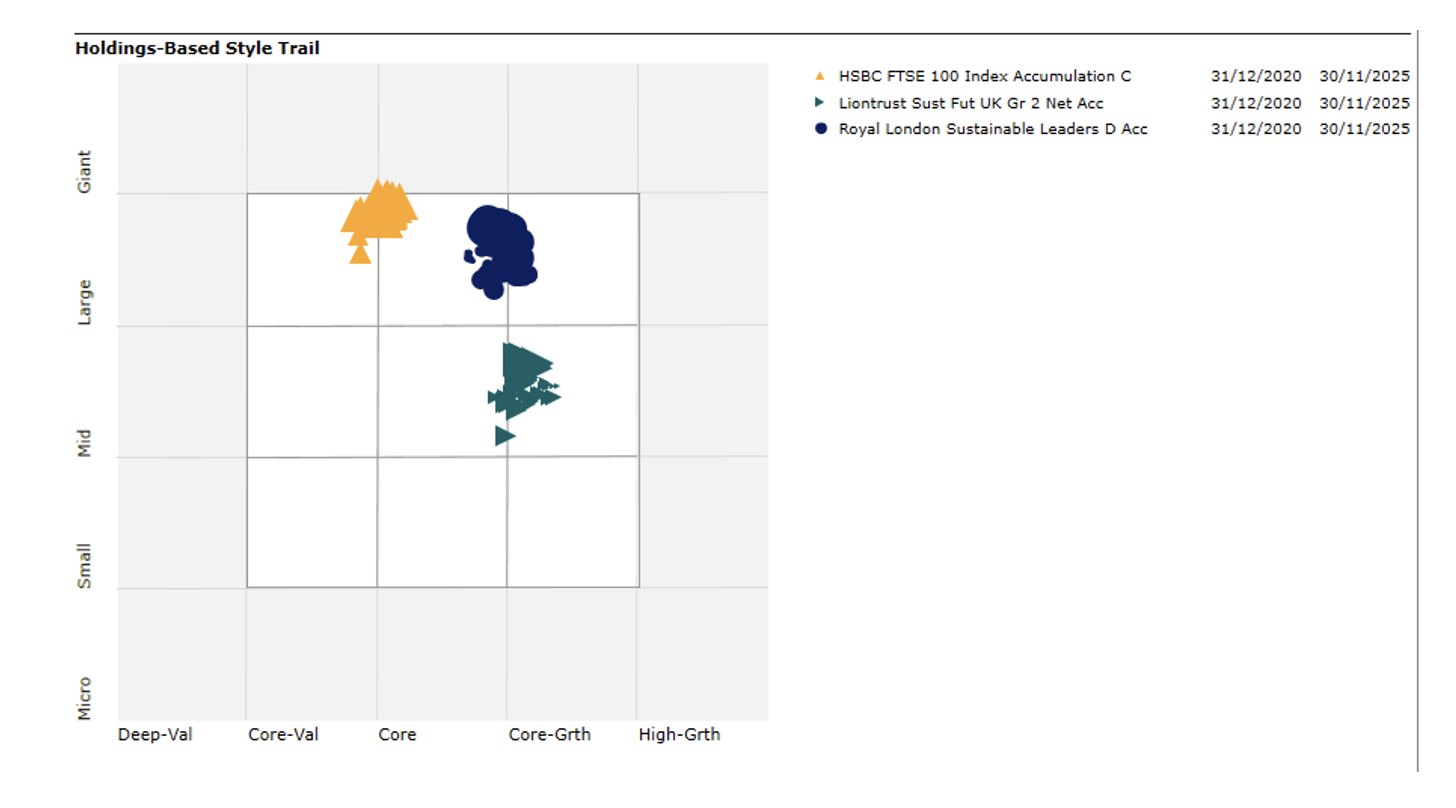

In the UK, market leadership has come from financials, defence and mining: sectors typically associated with value investing. These areas drove index returns to over 20% for the year. As discussed, sustainable funds generally have limited exposure to these sectors, making underperformance unsurprising. The chart below illustrates the style exposure of the index (orange) versus two sustainable funds, highlighting why the index outperformed in a year dominated by large-cap value. The Royal London fund, with greater exposure to large-cap stocks, outperformed the Liontrust Fund, but both lagged the index due to their structural growth bias.

Source: Morningstar

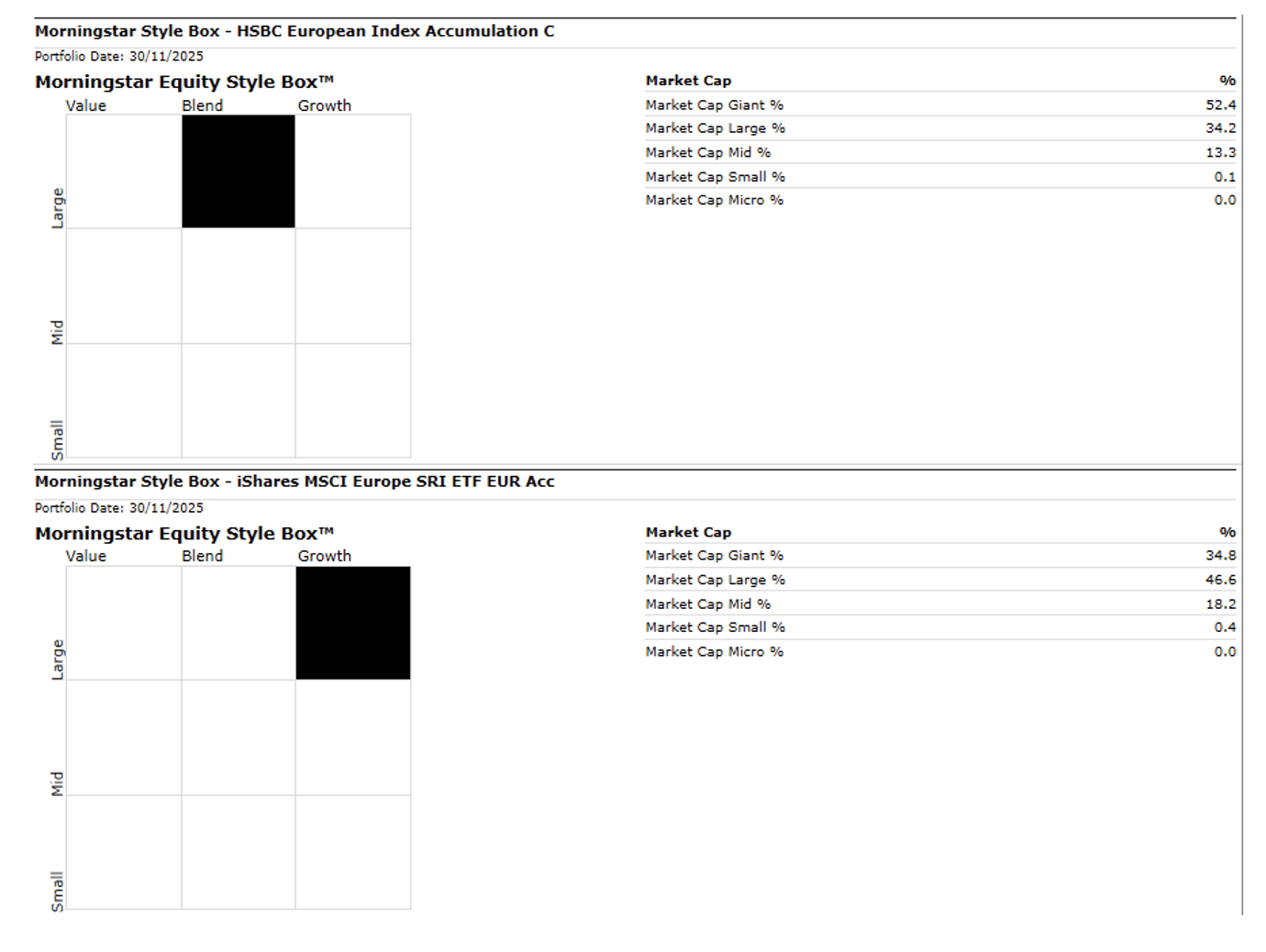

A similar pattern emerged in Europe, where a mid-cap growth tilt detracted from relative performance as large-cap value stocks significantly outperformed.

Source: Morningstar

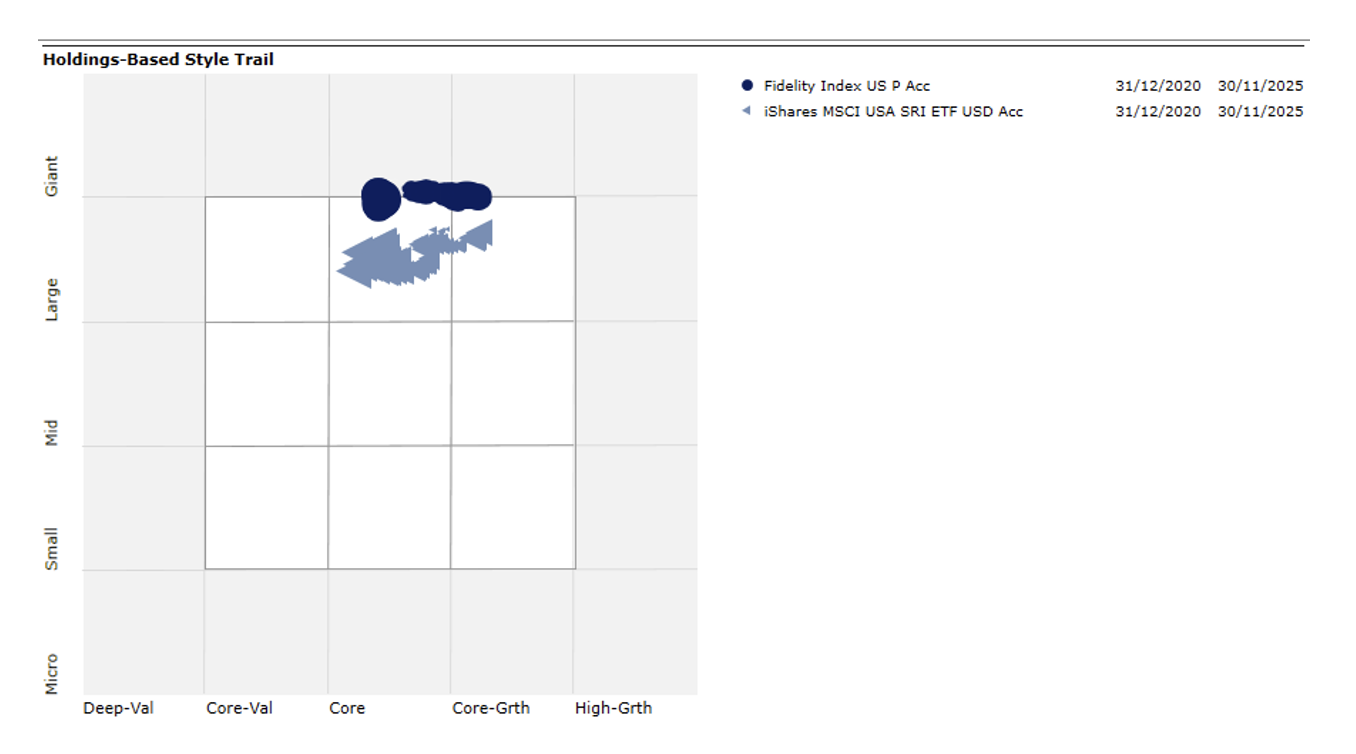

In the US, the underperformance of sustainable strategies was less pronounced. The US market is structurally more growth-oriented than the UK or Europe, and growth stocks continued to dominate returns. However, performance dispersion still emerged as larger companies drove much of the market’s gains.

Source: Morningstar

2025 saw an increasingly uncertain geopolitical and macroeconomic environment, encouraging investors to diversify away from the growth sectors that dominated returns in recent years. During the year, traditionally defensive sectors delivered growth-like returns, further disadvantaging sustainability-tilted mandates. By shrinking the investable universe, sustainable strategies inherently reduce the range of tools available to portfolio managers. Consequently, when style and sector headwinds turn unfavourable, periods of underperformance should be expected.

Whilst sustainable mandates have faced significant headwinds in 2025, it is important to note that absolute returns have remained positive. A single year of relative underperformance does not imply that the investment style is fundamentally flawed. Sustainable portfolios will continue to be managed with ESG considerations at the core, reflecting a long-term belief in the link between responsible corporate behaviour and sustainable shareholder returns.

Markets and styles are inherently cyclical, and periods of underperformance are often followed by mean reversion over longer time horizons. Importantly, valuations across many areas to which sustainable portfolios are exposed are attractive. Given that starting valuations are a key driver of long-term returns, this provides a supportive backdrop for future performance.

Max West, Research Investment Analyst

Max joined CAM as a Research Investment Analyst in 2024, having graduated from the University of Leeds with a BSc and MSc in Economics. He works with the research team and provides analysis to inform CAM’s investment decisions across asset classes. Max is currently studying towards his Investment Management Certificate, but also enjoys a variety of sports in his spare time.