Company Cars: Rolling Down That Hill?

Source: HMRC

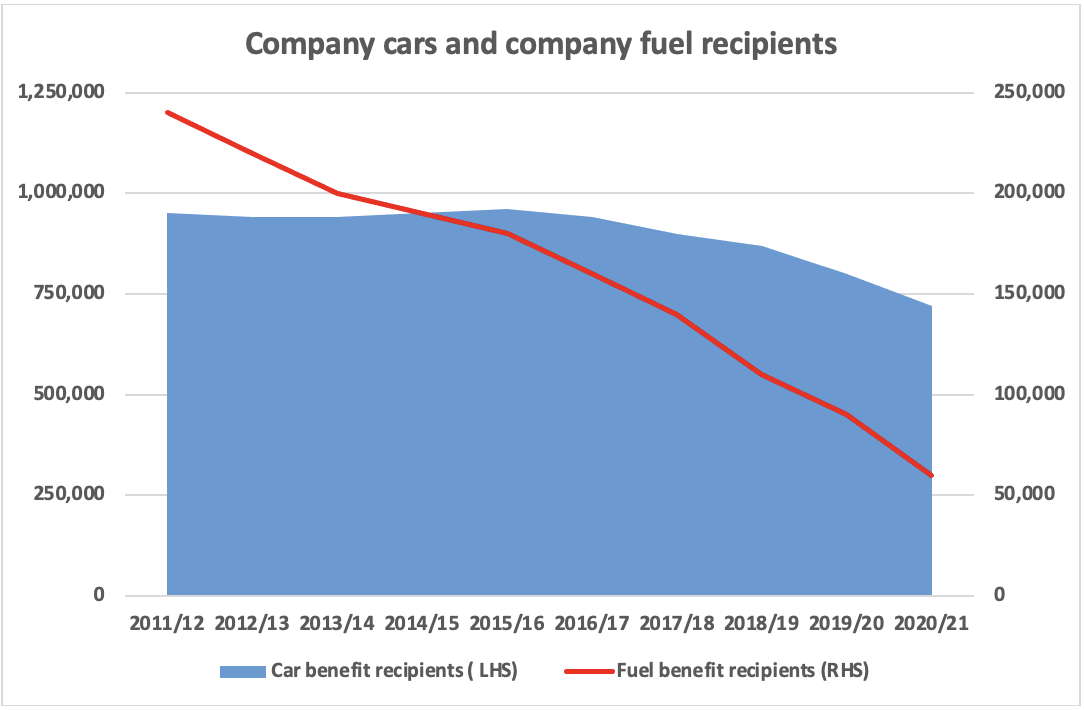

If you drive a company car, then, according to recent data from HMRC, you are in a shrinking minority. If you also have what is euphemistically called ‘free fuel’, then you are a member of an even smaller band – 60,000 in 2020/21.

Why the fall?

There are variety of reasons why the company car population is dwindling:

In April 2017 new legislation on optional remuneration arrangements (OpRA) was introduced by HMRC. This made it less attractive to sacrifice salary for a company car unless it was an ultra-low emission vehicle (under than 75g CO2 per kilometre). Hence all those Teslas…

Some employees have preferred to take extra cash, buy (or lease/PCP) their own car and claim tax-free mileage allowance for business travel (45p a mile for the first 10,000 miles and 25p thereafter).

The pandemic limited travel and encouraged working from home, a trend which has continued. If you are not going to the office each day, the company car becomes a less used and thus less valuable perk.

The dramatic drop in the popularity of ‘free fuel’ is due to its tax inefficiency. For example, in 2023/24 ‘free fuel’ would cost a higher rate taxpayer with an Audi A3 35TFSI £3,336 in tax (£27,800 x 30% @ 40%). If they spent that same amount on petrol at, say £1.60 a litre, they would have enough fuel to cover well over 20,000 miles…

Action

If you have a company car, make sure you know what the taxable benefit is and that HMRC also have the correct figure. When the car falls due for replacement, it could be worth considering an electric vehicle, which is treated favourably for tax purposes.

While salary sacrifice is no longer attractive for most company cars, it remains a tax-efficient option for pension contributions. In our books, a comfortable retirement trumps motoring comfort any day.